Rumored Buzz on Pvm Accounting

Rumored Buzz on Pvm Accounting

Blog Article

Not known Facts About Pvm Accounting

Table of ContentsPvm Accounting for BeginnersAn Unbiased View of Pvm AccountingSome Known Details About Pvm Accounting The smart Trick of Pvm Accounting That Nobody is DiscussingThe smart Trick of Pvm Accounting That Nobody is Talking AboutPvm Accounting Fundamentals Explained

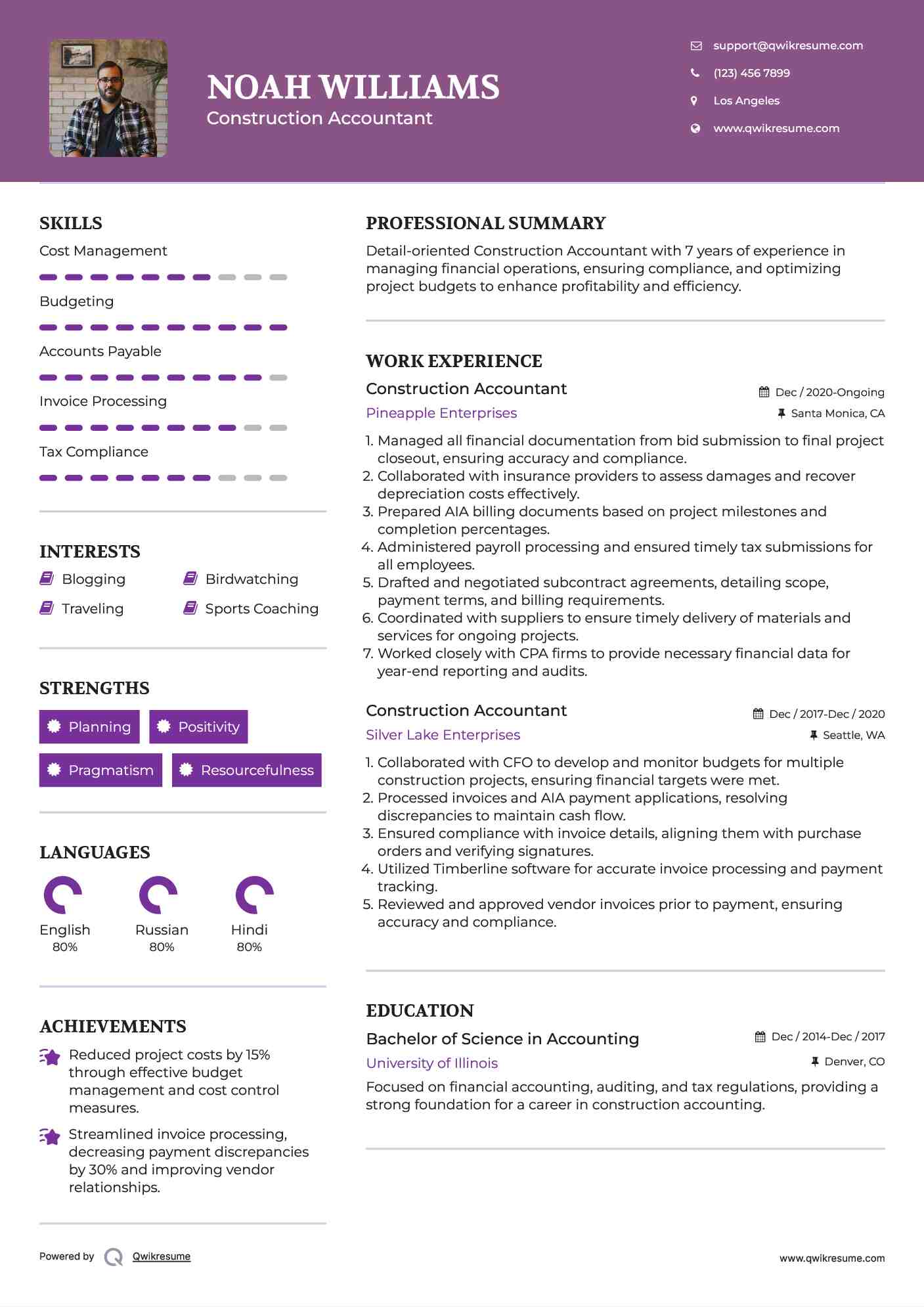

Manage and deal with the production and approval of all project-related billings to clients to promote great interaction and avoid issues. Clean-up bookkeeping. Make sure that ideal reports and paperwork are submitted to and are upgraded with the internal revenue service. Guarantee that the audit process adheres to the legislation. Apply needed building accounting criteria and procedures to the recording and reporting of building and construction task.Understand and keep typical price codes in the accounting system. Interact with numerous funding companies (i.e. Title Company, Escrow Business) relating to the pay application process and demands needed for settlement. Manage lien waiver disbursement and collection - https://pvm-accounting.jimdosite.com. Screen and fix bank issues including fee abnormalities and check distinctions. Aid with implementing and preserving internal financial controls and procedures.

The above statements are intended to explain the basic nature and degree of job being carried out by people appointed to this classification. They are not to be understood as an extensive listing of responsibilities, obligations, and abilities needed. Employees may be required to execute responsibilities outside of their normal duties every so often, as needed.

Our Pvm Accounting Ideas

Accel is looking for a Building Accountant for the Chicago Office. The Building Accounting professional carries out a selection of audit, insurance conformity, and job management.

Principal duties consist of, however are not limited to, dealing with all accounting features of the business in a prompt and accurate manner and supplying records and schedules to the company's CPA Firm in the prep work of all economic declarations. Guarantees that all accountancy procedures and features are managed properly. Accountable for all monetary documents, payroll, banking and day-to-day procedure of the audit feature.

Works with Job Managers to prepare and publish all monthly invoices. Creates regular monthly Task Price to Date reports and functioning with PMs to reconcile with Job Managers' spending plans for each job.

Rumored Buzz on Pvm Accounting

Effectiveness in Sage 300 Construction and Property (formerly Sage Timberline Workplace) and Procore building and construction monitoring software application an and also. https://www.find-us-here.com/businesses/PVM-Accounting-Washington-District-of-Columbia-USA/34067332/. Must also be skillful in other computer system software systems for the preparation of reports, spreadsheets and other bookkeeping analysis that may be needed by administration. Clean-up bookkeeping. Have to have strong organizational abilities and ability to focus on

They are the monetary custodians who make sure that building and construction jobs remain on budget, adhere to tax obligation policies, and keep monetary transparency. Building accountants are not simply number crunchers; they are critical companions in the building process. Their key duty is to manage the financial aspects of construction tasks, making sure that sources are designated effectively and economic threats are minimized.

The smart Trick of Pvm Accounting That Nobody is Talking About

They work closely with project supervisors to create and check budget plans, track costs, and forecast economic demands. By maintaining a limited grip on task financial resources, accountants aid prevent overspending and economic problems. Budgeting is a foundation of successful building projects, and building accountants contribute in this respect. They produce in-depth budgets that encompass all task expenditures, from materials and labor to permits and insurance.

Browsing the complex internet of tax obligation guidelines in the building and construction industry can be difficult. Building and construction accounting professionals are fluent in these guidelines and make sure that the job abides with all tax obligation demands. This consists of handling pay-roll taxes, sales tax obligations, and any type of other tax commitments specific to building. To master the duty of a construction accountant, people require a strong educational structure in audit and finance.

Furthermore, certifications such as Licensed Public Accounting get redirected here Professional (CERTIFIED PUBLIC ACCOUNTANT) or Certified Construction Market Financial Specialist (CCIFP) are highly concerned in the market. Building and construction jobs frequently entail tight target dates, altering policies, and unexpected expenditures.

Pvm Accounting - The Facts

Ans: Construction accountants create and keep an eye on budget plans, identifying cost-saving possibilities and making sure that the task stays within budget plan. Ans: Yes, building accounting professionals handle tax obligation compliance for building and construction tasks.

Introduction to Building Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among numerous financial choices, like bidding on one project over one more, selecting financing for materials or equipment, or establishing a job's earnings margin. Construction is a notoriously volatile industry with a high failure rate, slow time to settlement, and irregular cash money flow.

Common manufacturerConstruction organization Process-based. Production includes duplicated procedures with easily identifiable expenses. Project-based. Production calls for different procedures, products, and tools with differing costs. Dealt with area. Production or manufacturing takes place in a single (or several) controlled locations. Decentralized. Each job occurs in a new location with varying website conditions and one-of-a-kind challenges.

Getting My Pvm Accounting To Work

Frequent use of different specialized professionals and suppliers impacts performance and cash money circulation. Settlement arrives in full or with regular payments for the complete agreement amount. Some portion of repayment may be kept until task completion even when the contractor's work is ended up.

While standard makers have the advantage of regulated atmospheres and enhanced production procedures, building firms need to frequently adapt to each brand-new project. Even somewhat repeatable tasks require adjustments due to website problems and various other factors.

Report this page